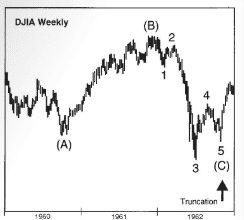

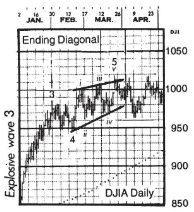

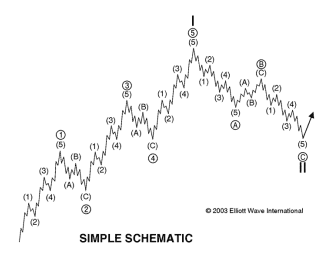

Example of an Elliott Wave counting method taken from the book Elliott Wave Principle

Specifically, Elliott Waves represent the shift in crowd psychology from optimism to pessimism and vice versa. These psychological shifts influence prices, which is the source of asset price movements. Price movements, as well as crowd psychology, are expressed through patterns that repeat, forming fractal phenomena.

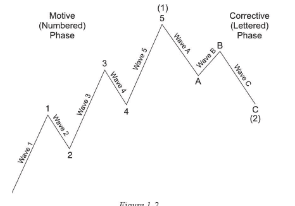

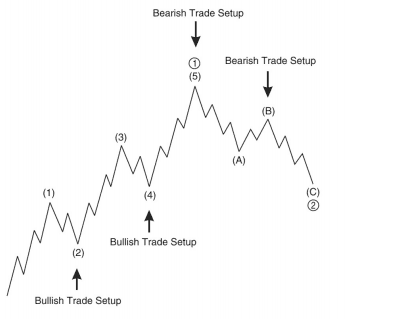

One bullish Elliott Wave cycle consists of 5 impulse waves and 3 corrective waves

Fractal phenomenon: 5 upward waves and 3 downward waves repeating within larger 5-3 wave sequences.

Fractal phenomenon:

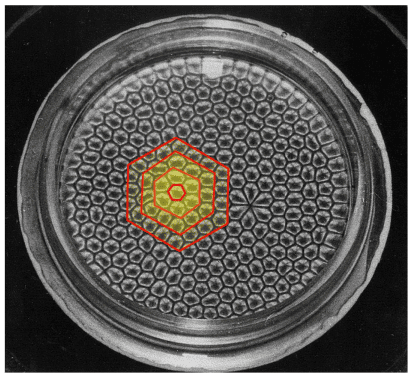

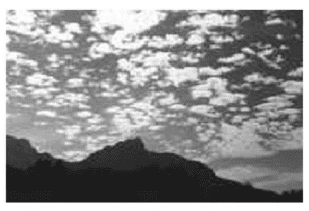

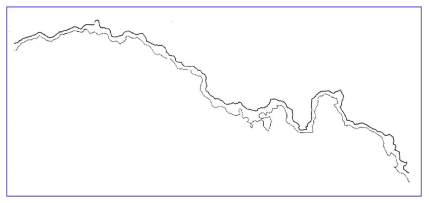

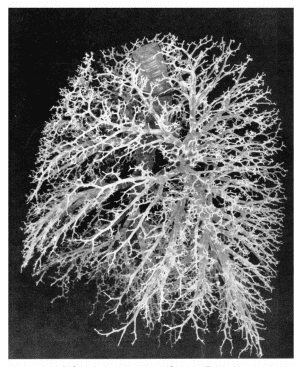

We will discuss the fractal phenomenon in more detail later. According to many experts, fractals are not only found in financial markets but also in nature around us. The examples below illustrate how growth and decay in financial markets are quite similar to natural fractal patterns.

Fractals in heated silicone oil molecules

Fractals among clouds

Coastline vs. stock index prices

Fractals in tree branches

Fractals in human lung alveoli

An Elliott Wave cycle consists of 5 waves following the main trend and 3 waves against the trend. Specifically, if the 5 waves are upward, the main trend is bullish, while the 3 downward waves form the dominant bearish trend.