Elliott Wave is a fairly common methodology, however, applying it is not easy.

The admin has listed the main tips in this article for those using wave patterns to refer to:

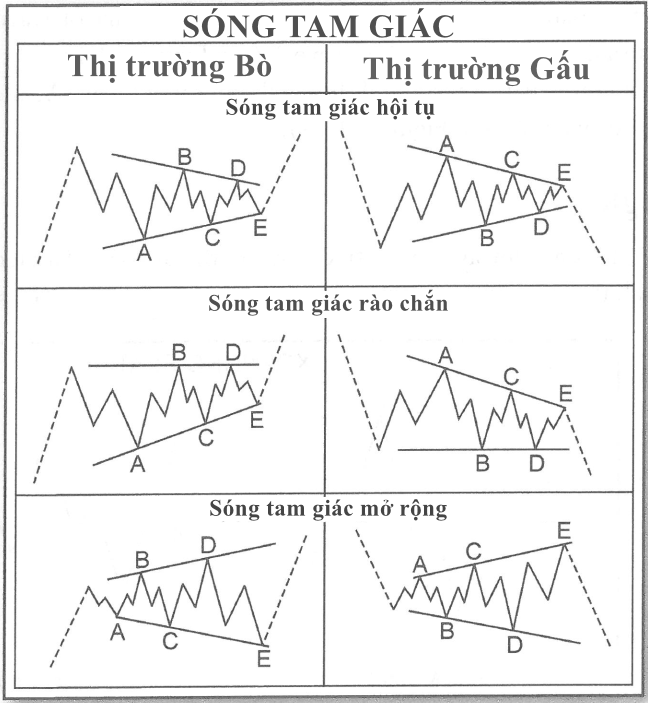

- The first difficulty is that there are many patterns with various corrective wave movements such as Zigzag and Flat waves, and during the formation process, it may have a high probability of following many different patterns

- The second challenge is in locating the structure in the case of extended waves, for example, expanded 3-wave or expanded 5-wave as those i mentioned in another article with the link here or the two senario of SP500 long term wave count below

- The third obstacle is that irregular wave patterns (less common waves) such as Expanded, truncated, or broken waves often make it difficult to accurately identify the wave structure.

So, the question here how to use Elliottwave to achieve success and maximum profit?

- Firstly, 5 waves patternwill set-up the dominant trend; however, it’s vital to have a confirmation that: the following wave must be 3 waves. i called this “hight propability set-up,” meaning it will always be high accuracy, high win rate.

- Secondly, when you see a sharp price drop accompanied by a gap, the probability is 3. Therefore, waiting for wave 4 to correct and participating in wave 5 will be a good setup with a high success rate.

- Finally, if long term wave count is unclear, we can rely on short-term clear pattern as those the ending diagonal set-up on hourly chart of SP500

So if want to upgrade your elliott wave counting, you can refer to our paid service like Elliott wave album where you can saw my labeling or video-based tutor of real-life elliott wave applying